Mortgage Matters-October 23, 2024

We over here at Your Mortgage Needs have made a commitment to continue to provide you with pertinent updates on all things mortgage. That means that we will continue to show up in your inbox on a regular basis!

Market Insights

Amazing News announced today!

The Bank of Canada delivered a whopping 0.50% rate cut this morning, bring Prime Lending rate down to 5.95% from 6.45%!

This affects you if you are in a variable rate mortgage or have a variable rate loan product.

How much does this affect you and your payment? If you owe $200,000 for example, your payment would drop by about $60/month!

Keep in mind that it would reflect on your next month's payment, unless you have a fixed payment. In that case more would go to principal and less would go to interest.

If you are renewing your mortgage or getting a new mortgage that hasn't closed yet and have selected a fixed rate mortgage, this does not mean that your rate has dropped. Fixed rate mortgages are tied to the bond market, and in the last couple of days we have actually seen a slight increase in bond yields. When this happens we sometimes see that reflected in an increase in fixed rates.

I do suspect that we will continue to see fixed interest rates drop over time and go under 4%. In order for rates to drop under 2% we know what needs to happen-an economic crisis like the pandemic. I don't think any of us want that!

If you are unsure whether to take a fixed or variable rate mortgage, reach out to us. We can discuss what is right for you!

So Many Mortgage Rule Changes are Coming!

Recently, the Federal Government announced some pretty sweet changes to mortgage lending, my dear client. Here is a summary of those changes:

Effective November 21, 2024

- When switching your mortgage to another lender at renewal, you no longer need to qualify at the Stress Test Rate and instead can qualify at the actual contract rate. This is huge as it allows borrowers to have a choice at renewal if another lender is offering a better rate than their current mortgage lender.

Effective December 15, 2024

- First time home buyers and buyers of New Construction homes can now extend their payments over 30 years (previously 25 years). A first time home buyer has either:

- Never purchased a home before.

- Not owned or occupied a principal residence in the last four years.

- Recently experienced a breakdown in a marriage or common-law relationship, in line with the Canada Revenue Agency’s approach to the Home Buyers’ Plan.

- The cap for insured purchases has been increased from $1 million to $1.5 million

Effective January 15, 2025

- Homeowners can access up to 90% of their home's value in order to refinance to build a secondary suite. This is to help combat the shortage of rental units in the country. Here is the Coles Notes on the rules (courtesy of Canadian Mortgage Trends):

- Maximum loan-to-value (LTV): The LTV ratio can be up to 90% of the “as improved” property value, with the total property value capped at $2 million.

- Amortization period: The maximum amortization for this refinancing is 30 years, allowing borrowers to spread payments over a longer term.

- Number of units: Homeowners can add up to four units on their property, including the existing one.

- Self-contained units: Each secondary suite must be a fully self-contained unit, meaning it has separate living facilities, such as a private entrance, kitchen, and bathroom. This ensures compliance with municipal zoning requirements.

- No short-term rentals: The additional units must be long-term rentals and cannot be used for short-term rental purposes (e.g., Airbnb).

We are still waiting for communication from our lenders on how this will play out, but expect to have something soon. At that time we will communicate that to you. Either way, this is great news!

If you are intrigued by any of these changes, please reach out by email here!

It might be time to have a strategy session!

Are you a First-time Home Buyer looking to buy in 2025? Here are some neat strategies for you with regards to your down-payment!

As a First Time Home buyer, the government has some great programs to assist you, and you can use this to your advantage today. Here are some tips and tricks you can use to possibly put more money in your pocket when you are ready to buy!

Tip # 1

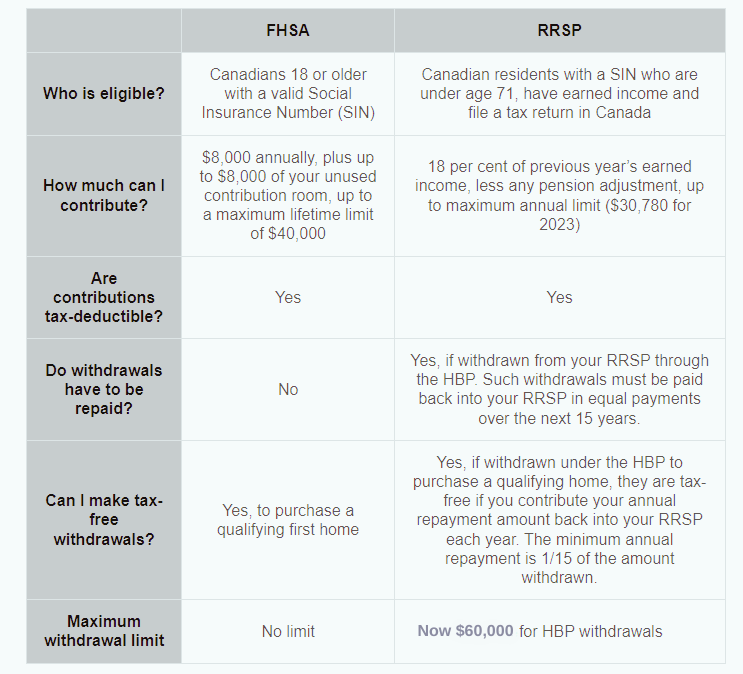

Invest your down-payment in the First Home Savings Account today. You are allowed to contribute $8000/year up to $40,000 and then withdraw it tax free when you are ready to buy a home.

The best part? Unlike the RRSP Home Buyers Plan, you can withdraw it a day after you contribute the funds and still get the tax benefit!

Tip # 2

As a First Time Home Buyer, you can withdraw up to $60,000 from your RRSP tax free when you are ready to buy. The catch? The funds must have been sitting in your RRSP for 90 days before you are able to withdraw the funds.

If you are looking to purchase in 2025, you could move your down-payment funds into your RRSP now and report the contribution on your 2024 income tax return which may result in a tax refund for you. Then, when you are ready, you can withdraw those funds tax free. Just make sure that you invest in an open, low risk RRSP if you decide to do this.

If you are getting a gift from family and they are able to give you the funds earlier, this strategy could work as well!

Remember, it is $60,000 per First time buyer, so if you are buying with a partner and they also qualify as a first time buyer that would equal $120,000 in eligible down-payment room!

Here are the links to the program details:

Chart Below (Courtesy of this Globe and Mail article)

We Love Referrals and Reviews from Happy Clients!

The greatest gift we can receive is a referral from a happy client. If someone in your circle is talking about a mortgage, please pass on our name! And if you can take a couple of minutes to leave a review we would love that?